oregon workers benefit fund tax rate

You are responsible for any necessary. In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment.

Oregon S Nonresident Workers Article Display Content Qualityinfo

If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under.

. The workers benefit fund assessment rate will be 22 cents per hour in 2023 Employers are required to pay at least 11 cents per hour Oregon Workers Compensation. The detailed information for Workers Benefit Fund Oregon 2020 is provided. 3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

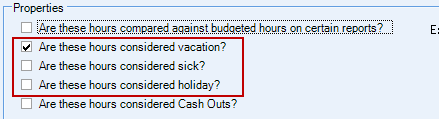

How much is the WBF rate per hour. Prescribe the rate of the Workers Benefit Fund assessment under ORS 656506. Enter the tax formula and table rate information.

NE Salem Oregon 97301. For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. Oregon workers are subject to Workers Benefit Fund WBF assessment tax.

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. For example The 2017-2018. Oregon Workers Benefit Fund Payroll Tax Overview.

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. For 2019 our analysts. You are responsible for any necessary.

653026 Nonurban county defined for ORS. This assessment is calculated based on employees per hour worked. Help users access the login page while offering essential notes during the login process.

Go online at httpswww. What is the Oregon WBF tax rate. The 2022 payroll tax schedule is a.

For 2022 the rate is 22 cents per hour. Enter the tax formula and table rate information. The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked.

You are responsible for any. Oregon Workers Benefit Fund WBF assessment Note. Oregon workers benefit fund tax rate Saturday June 18 2022 Edit.

The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour. These coronavirus stimulus checks from Oregon however would go only to low-income workers. 40 hours 0014 056.

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged. Prescribe the rate of the Workers Benefit Fund assessment under. What is the 2022 tax rate.

Workers Benefit Fund Assessment Oregon Administrative Rules Chapter 436 Division 070 Effective Jan. Remains at 98 percent in 2023 Self-insured employers and public-sector self-insured employer groups pay 99 percent Private-sector self-insured employer groups pay 103 percent Covers. Example of how the WBF assessment is calculated This example uses the 2017-2018 WBF rate of 28 cents.

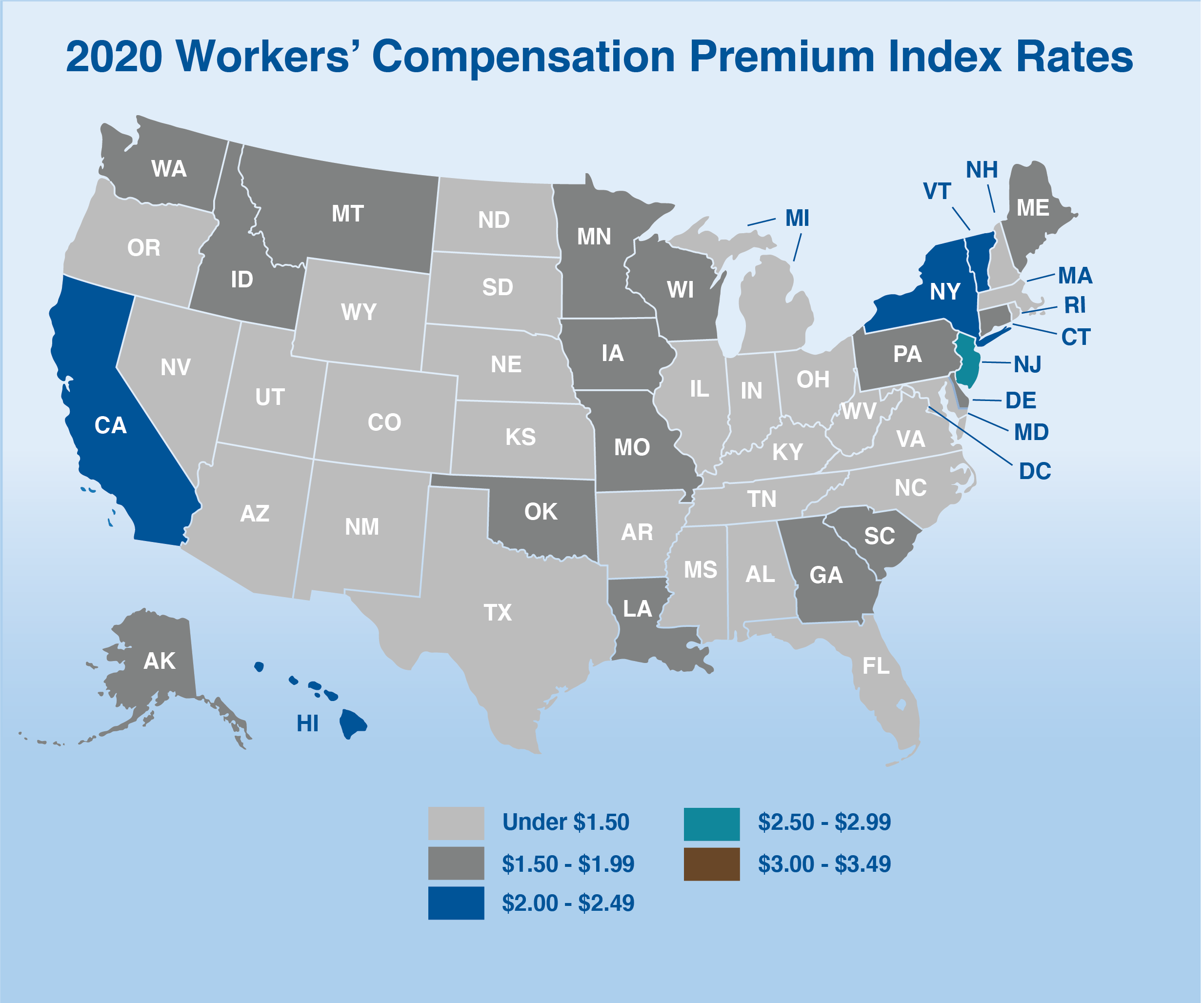

Workers Compensation Overview And Issues Everycrsreport Com

What Is The Oregon Transit Tax Statewide Local

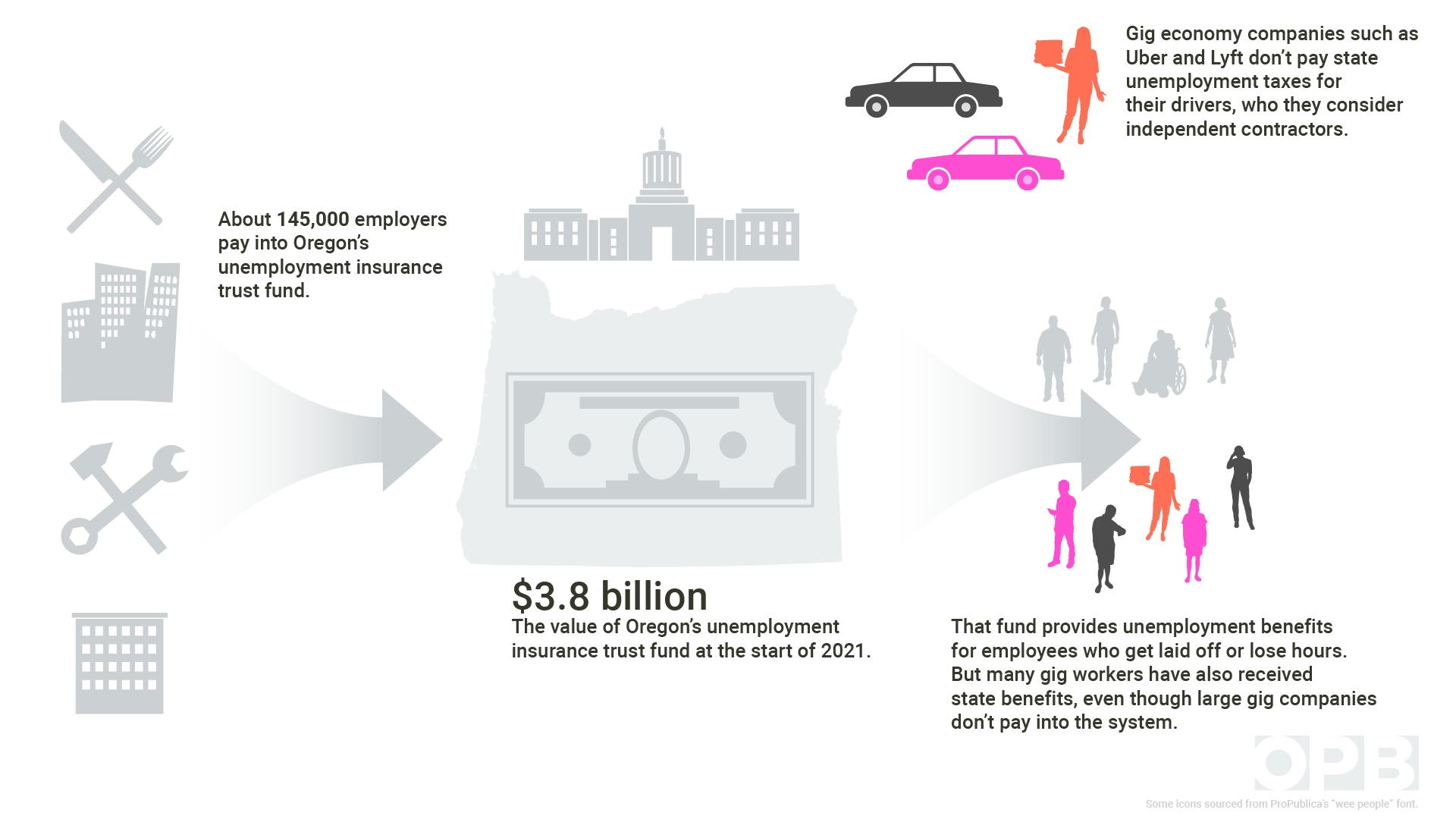

Many Oregon Gig Workers Got Regular Unemployment Benefits Here S Why It Matters Opb

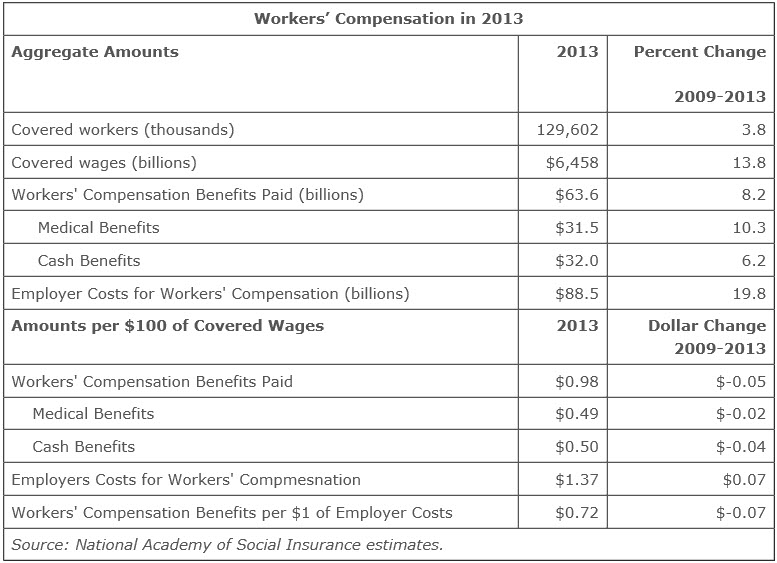

Workers Compensation Benefits For Injured Workers Continue To Decline While Employer Costs Rise Recent Cases News Trends Developments Workers Compensation Lexisnexis Legal Newsroom

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Altered State A Checklist For Change In New York State Empire Center For Public Policy

Workers Comp Or Disability Which Is Better Kbg Injury Law

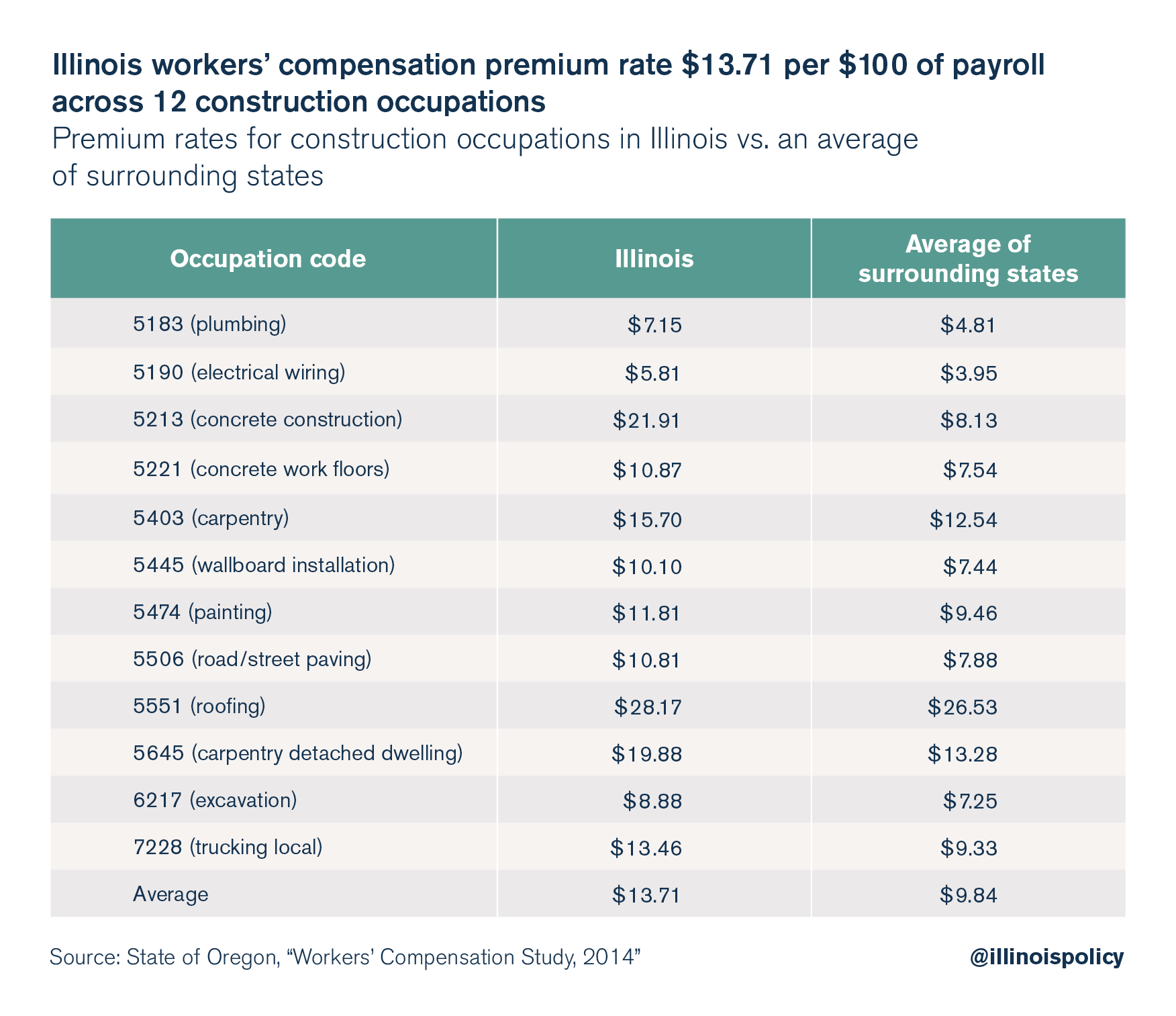

Workers Compensation Estimated To Cost Illinois Taxpayers Nearly 1 Billion Per Year Illinois Policy

2021 State Business Tax Climate Index Tax Foundation

Average Price Of Washington Workers Compensation Insurance Will Go Up Slightly In 2022 Local Bigcountrynewsconnection Com

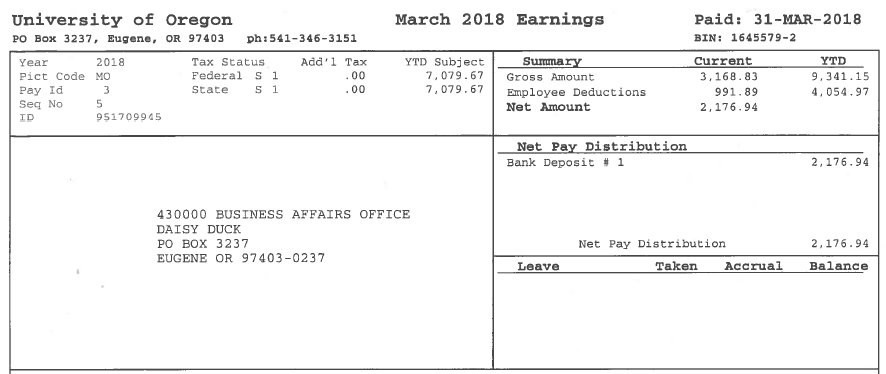

How To Read Your Earning Statement Business Affairs

Oregon Workers Benefit Fund Payroll Tax

Oregon Nanny Tax Rules Poppins Payroll Poppins Payroll

Oregon Lowers Payroll Tax Rate For 2022 Local Kdrv Com

Benefit Adequacy In State Workers Compensation Programs

Workers Compensation Laws By State Embroker

What Is My State Unemployment Tax Rate 2022 Suta Rates By State