taxes to go up in 2021

In Seattle for example residents saw their average tax bill go up by 633 from 2020 to 2021 as county officials bumped up the tax rate. The Districts estate tax exemption has dropped to 4 million for 2021.

When Is The Deadline For Filing 2021 Taxes Wltx Com

The Joint Committee on Taxation released a chart indicating that federal taxes for those making between 10000 and 30000 would actually go up starting in 2021.

. How much will taxes go up in 2021. The standard deduction for 2021 increased to 12550 for single filers and 25100 for married couples filing jointly. Global minimum tax.

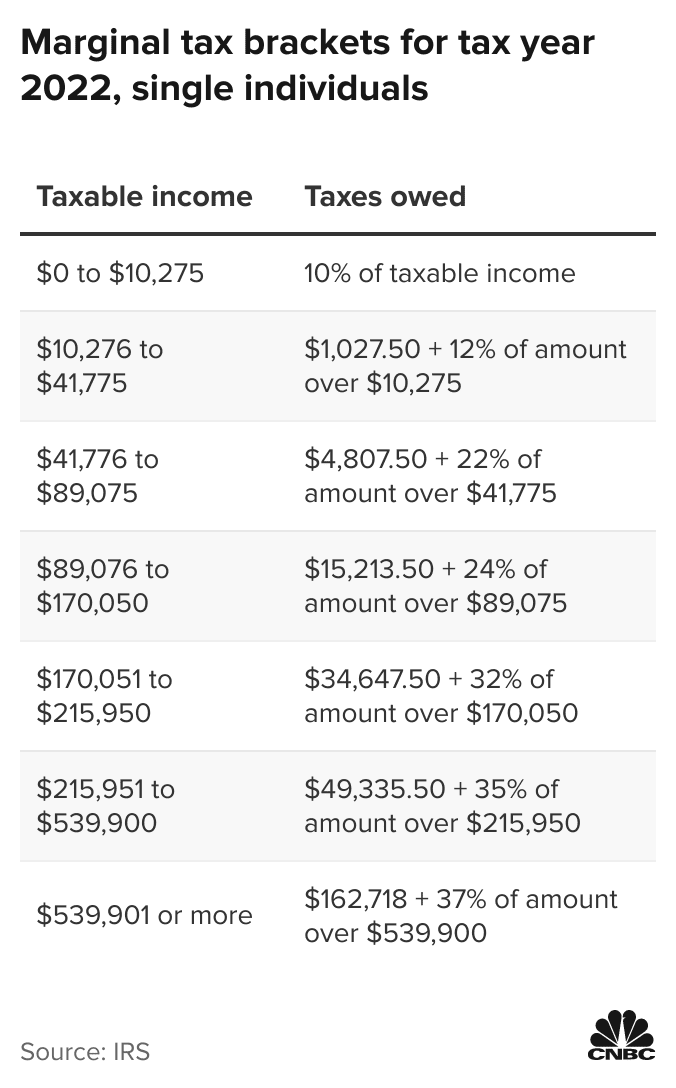

Previously the exemption was close to 58 million matching the pre-TCJA federal level and adjusted for. For 2021 the top tax rate of 37 will apply to individual taxpayers with income over 523600 628300 for married filing jointly. Single filers can exclude up to 250000 while couples can exclude up to 500000 from the sale of their home.

After 11302022 TurboTax Live Full Service customers will be able to amend their. Raising the corporate rate to 25 percent would raise about 5221 billion between 2022 and 2031 on a. For 2021 standard deductions increased by 150 to 300 from tax year 2020 rates.

Will federal taxes go up in 2022. Income tax brackets increased in 2021 to account for inflation. The proposal read about it here along with US negotiations with other G20 nations would increase the minimum tax on US corporations to 21 and.

Standard deduction rates for tax year 2021 are. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022. 20 with AGI up to 22000 10 with AGI up to 34000 38 Frequently Asked Questions What were the 2021 tax brackets.

2022 Tax Brackets There are seven tax brackets that range from 10 to 37. According to Statista the average sales price of a new. The breakpoint for each tax bracket will be about 3 higher across the board in 2021.

Single Or Married Filing Separately. Tax Foundation General Equilibrium Model January 2021. How will income tax change in 2021.

Four months ago President Trump signed an executive memorandum allowing employers to temporarily suspend the 62 federal payroll tax withholdings that go toward. Tax rates remain unchanged for 2021 but the brackets. See the highlighted cells below which were the JCTs estimates for the average changes in federal taxes for those earning between 10000 and 30000 in 2021.

The seven federal tax brackets for tax year 2021. Changes in Tax Brackets and Tax Rates for 2022.

Education Tax Credits For College Students The Official Blog Of Taxslayer

Will Your Taxes Go Up Or Down Under The Biden Tax Plan The Wolf Group

Opinion Make Tax Dodging Companies Pay For Biden S Infrastructure Plan The New York Times

Taxes 2021 7 Upcoming Tax Law Changes Thestreet

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Portland Property Taxes Going Up In 2022 Real Estate Agent Pdx

Are My Taxes Going Up In 2021 Certifiably Financial

When Is Tax Day 2021 Where Can I File My Taxes Online How Do I File Taxes Online How Do I Sign Up For Turbotax H R Block Or Tax Slayer Can I

2021 Proposed Tax Law Changes Potential Impacts

State Individual Income Tax Rates And Brackets Tax Foundation

Property Taxes Going Up At Pottsville Area School District Coal Region Canary

Average 2021 Tax Refund Up From Past 3 Years Fox Business

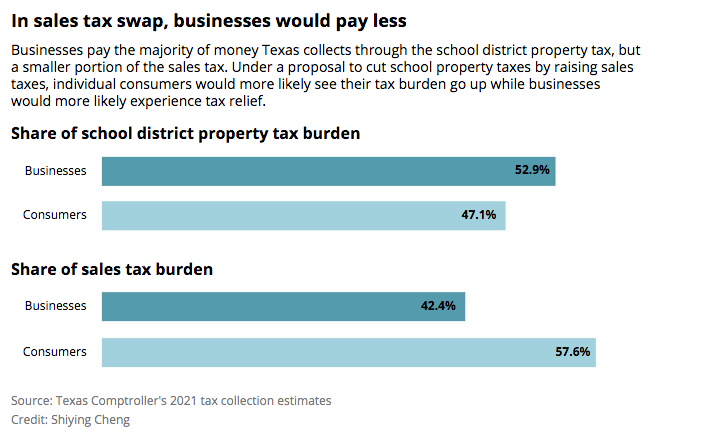

A Texas Sales Tax Increase Would Hit Poor People The Hardest Free Theparisnews Com

Are Taxes Going Up In 2021 Paypath

New Buncombe County Committee On Tax Appraisal Inequity

With Taxes Going Up Cannabis Operators Threaten California Weed Party

Up 13 3 Capitol Hill Residential Property Valuations Climb Again In 2022 Chs Capitol Hill Seattle

What Is Up With President Biden S Tax Proposals Succession Planning